Whether you’re a current or former employee of Verizon in the US, accessing and understanding your pay information is essential for managing personal finances, verifying income, and ensuring accuracy. Verizon provides systems for employees to view their earnings and deductions electronically. This guide outlines how you can typically access and review your verizon paycheck details.

Accessing Your Paycheck Information (Current Employees)

For those currently employed by Verizon, pay stubs and related payroll information are usually accessible through a dedicated internal employee portal.

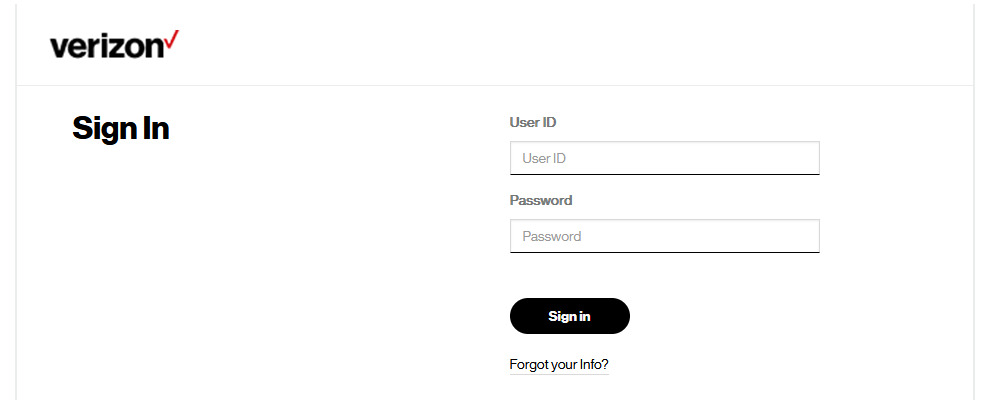

Logging into the Employee Portal

- Find the Portal: Access the specific Verizon employee portal designated for your role or division. This link or URL is typically provided during onboarding or available through company resources. It might be referred to as “About You,” require Single Sign-On (SSO), or have another internal name.

- Enter Credentials: Log in using your unique Verizon employee ID (like a VZID or USWIN) and your network password.

- Navigate to Payroll: Once logged in, look for sections labeled “Payroll,” “Pay,” “My Pay,” or “Employee Services” on the portal’s dashboard or menu.

- View Pay Stubs: Within the payroll section, you should find options to view your pay stubs (“Earnings Statements”). These are usually organized by pay period date. You can typically view them online and download them as PDF files for your records.

If you encounter issues logging in or finding the information, contact Verizon’s internal IT Help Desk or your HR department.

Read more about: consumer cellular vs verizon

Accessing Pay Information (Former Employees)

Verizon provides a way for former US-based employees to access historical pay and tax information after leaving the company.

Using the Work History Site

- Access the Site: Navigate to the dedicated portal, typically found at https://workhistory.verizon.com.

- Log In: Use your former employee ID (usually VZID or USWIN, often required in lowercase) and the password you set up for this site.

- First-Time Login: If you haven’t logged in since leaving, your initial default password might be a combination of your User ID and your birth year (e.g., v123451980). You will be required to change this password, set up security questions, and provide a personal email address (not @verizon.com) during your first login. An activation link will be sent to your personal email to complete the setup.

- View Information: Once logged in, you can typically access:

- Historical Paychecks (often available for up to 4 years post-separation).

- W-2 and 1095-C Tax Forms (often available for up to 7 years post-separation). You may need to provide electronic consent again after separation to view current year forms online.

For support with the Work History site, former employees may be directed to contact specific email addresses like [email protected] or HR Answers ([email protected]).

Payment Methods and Frequency

- Direct Deposit: Like most large US corporations, Verizon typically pays employees via direct deposit into their designated bank account(s). Employees usually set this up during onboarding or through the employee self-service portal.

- Pay Frequency: While specific pay cycles can vary by role or division, common frequencies in the US are bi-weekly (paid every two weeks, resulting in 26 paychecks per year) or semi-monthly (paid twice a month on set dates, e.g., the 15th and 30th, resulting in 24 paychecks per year). Your specific pay frequency should be detailed in your employment information.

Understanding Your Verizon Pay Stub

Your pay stub contains vital details about your earnings and deductions for a specific pay period. Key sections typically include:

- Employee Information: Name, Address, Employee ID.

- Pay Period Dates: The start and end dates covered by the paycheck.

- Gross Earnings: Your total earnings before any deductions (including regular hours, overtime, bonuses, commissions, etc.).

- Taxes: Withholdings for Federal income tax, State income tax, Local income tax (if applicable), Social Security (FICA), and Medicare taxes.

- Pre-Tax Deductions: Amounts taken out before taxes are calculated (e.g., contributions to 401(k) retirement plans, health insurance premiums, flexible spending accounts).

- Post-Tax Deductions: Amounts taken out after taxes (e.g., Roth 401(k) contributions, garnishments, certain benefit contributions).

- Net Pay: Your take-home pay after all taxes and deductions (Gross Pay – Taxes – Deductions = Net Pay).

- Year-to-Date (YTD) Totals: Running totals for earnings, taxes, and deductions for the current calendar year.

Getting Help with Your Verizon Paycheck

If you have questions about your pay, deductions, or accessing your pay stub:

- Current Employees: Your first point of contact should usually be your direct manager, the internal HR department, or the dedicated Payroll support team. Contact information or ticketing systems are typically available through the employee portal. IT support can help with portal login issues.

- Former Employees: Utilize the contact information provided through the Work History site or contact HR Answers/Global Payroll via email if you have trouble accessing historical information.