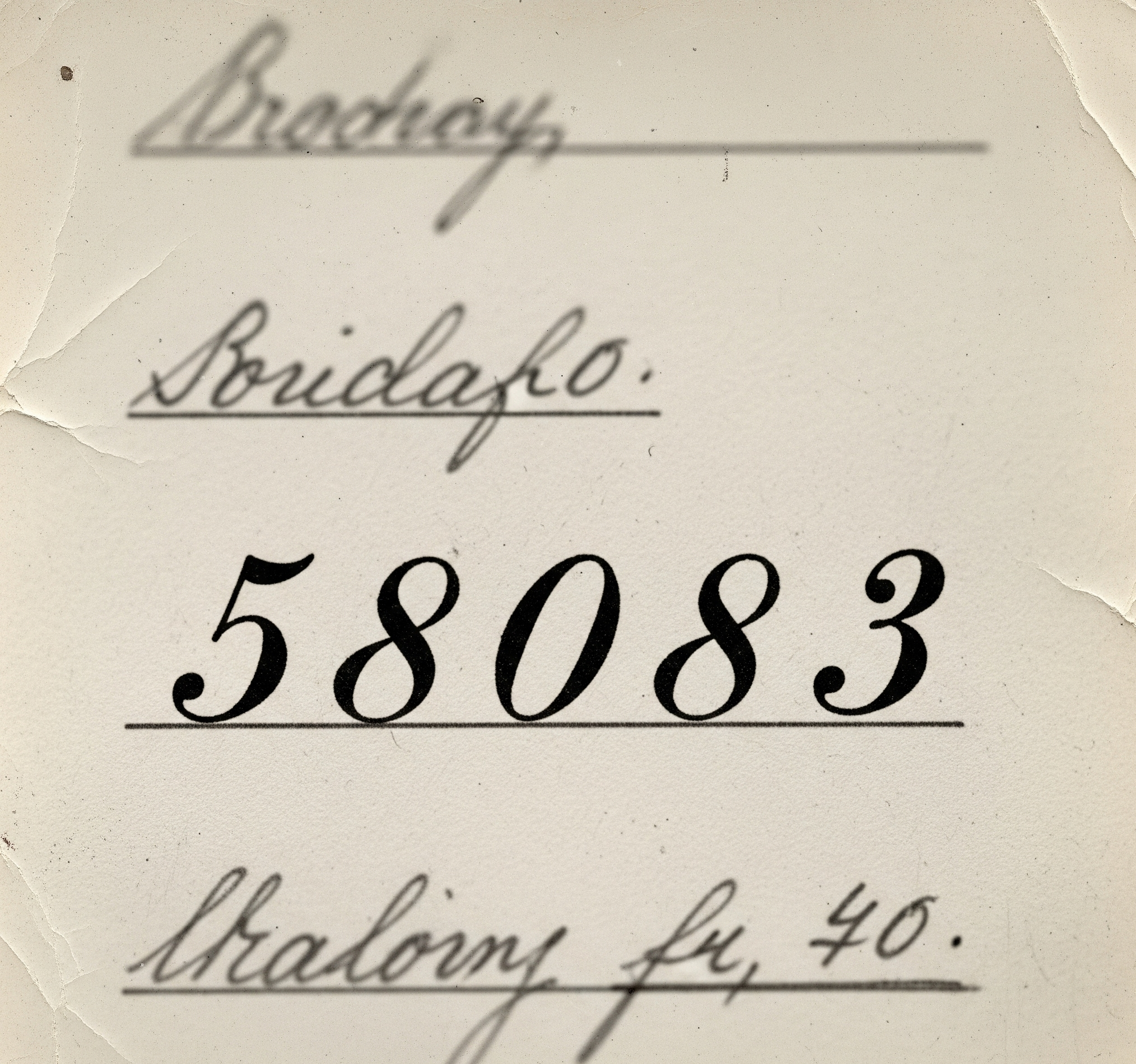

Receiving an unexpected text message from a strange number can be unsettling, especially when it mentions your finances. If you’ve received a text from 58083, you are right to be cautious. This 58083 short code is frequently used for automated messages, but it has become overwhelmingly associated with alerts from the financial service Affirm. Unfortunately, it is also a primary channel that criminals use for sophisticated phishing scams designed to steal your money and identity. An unsolicited 58083 text message, particularly one containing a verification code, requires your immediate and careful attention.

This definitive guide will walk you through everything you need to know about the text code 58083. You will learn precisely what this number is, the legitimate and fraudulent reasons you might be receiving a 58083 text, and how to confidently distinguish a genuine affirm text message from a dangerous affirm text scam. Most importantly, this article provides the exact, step-by-step actions you must take to secure your accounts, report the attempt, and protect your identity and finances from harm.

What Is the 58083 Short Code Text Message?

To understand the risk, it is first necessary to understand the technology. The 58083 text message you received did not come from a typical mobile phone. It came from a specialized system designed for mass communication, and the confusion about who operates it is a key part of why these scams can be effective.

Understanding SMS Short Codes

An SMS short code is a 5- or 6-digit number that businesses and other organizations use to send high volumes of text messages. Unlike a standard 10-digit phone number, these codes are specifically designed for application-to-person communication. Companies use the short code 58083 and others like it for a wide variety of communications, including marketing promotions, appointment reminders, and account alerts.

However, the most critical function in the context of the 58083 short code text message is sending security codes for two-factor authentication (2FA) and one-time passcodes.

Who Uses the 58083 Short Code?

One of the main reasons a text 58083 causes so much confusion is the conflicting information about who operates it. While some public directories might list the code under a different business name, the reality of the telecommunications industry is more complex. A company like Affirm can lease a short code or contract with a messaging service to send millions of texts for a specific purpose, like sending verification codes.

Therefore, the overwhelming volume of recent user reports exclusively link activity from 58083 to unsolicited verification codes from Affirm. For this reason, it is more practical to focus on the content and context of the message—specifically, the mention of 58083 Affirm—rather than getting sidetracked by potentially obsolete directory data. The message itself, regardless of its true origin, must be treated with extreme caution.

WARNING: Why You’re Getting an “Affirm Scam Text” from 58083

The primary reason people search for information about the 58083 short code is due to its strong association with phishing scams impersonating Affirm. While Affirm does use SMS for legitimate communication, criminals have learned to exploit this system.

The Direct Link: Unsolicited Affirm Verification Codes

Affirm is a legitimate “Buy Now, Pay Later” (BNPL) financial services company. As part of its standard security protocol, Affirm uses SMS to send a six-digit verification PIN when a user creates an account or signs in. This is a common and legitimate security feature. The company is fully aware that its system is being targeted by scammers and acknowledges that customers have been receiving unrequested PINs.

How Scammers Exploit This System: A Breakdown of the Phishing Attack

The affirm scam text is a classic example of social engineering. The scammer doesn’t need to hack Affirm’s servers; they only need to trick you.

- Step 1: The Setup. A scammer obtains your phone number, often from a data breach.

- Step 2: The Trigger. The scammer goes to the official Affirm website and initiates an action, like a password reset, using your phone number. This triggers Affirm’s legitimate security system to automatically send a real 58083 text code to your phone.

- Step 3: The Social Engineering. The scammer contacts you, often by phone, impersonating the “Affirm Security Department.” They will use a tone of urgency, claiming they need the code to block a fraudulent attempt on your account.

- Step 4: The Takeover. If you are deceived and provide the code, the scammer immediately enters it into the Affirm website. This allows them to take over your existing account or create a new, fraudulent one in your name. With this access, they can apply for loans and make purchases, leaving you responsible for the bill.

To protect yourself, remember this paramount rule: Affirm will NEVER call, email, or text you to ask for your password, PIN, or one-time verification code. Anyone who asks you for this code is a scammer. There are no exceptions.

Fact vs. Fiction: Separating Truth from Panic

While the threat of scams is very real, it is also important to have a nuanced understanding of the situation. Misconceptions can lead to unnecessary panic or a false sense of security.

Myth #1: “Every Text from 58083 Is a Malicious Scam.”

Fact: While every unsolicited message from 58083 must be treated as suspicious, there are common, benign scenarios that can trigger these texts. The most frequent cause is a “fat-finger” error, where a legitimate Affirm customer simply mistypes their own phone number. Another possibility is a recycled phone number; your number may have previously belonged to an Affirm customer. In either case, the text is harmless to you as long as you ignore and delete it. However, because scammers rely on this ambiguity, the correct course of action remains the same: treat all unsolicited codes with the highest level of suspicion.

Myth #2: “Affirm Itself Is a Scam Company.”

Fact: Affirm, Inc. is a legitimate, publicly traded financial technology company partnered with thousands of major U.S. retailers like Walmart and Amazon. Receiving a fake text message claiming to be from “Affirm” is functionally the same as receiving a fake text from “Chase.” Criminals impersonate large, trusted brands they know people will recognize.

Myth #3: “If I Get a Code, My Account Is Already Hacked.”

Fact: This is a critical misunderstanding. Receiving an unsolicited two-factor authentication (2FA) code is almost always a sign of an attempted security breach, not a successful one. The code is the key the hacker needs. Without it, they are locked out. Seeing the code means your phone number is successfully doing its job as a security barrier. The attack only succeeds if you are tricked into handing over that key.

Your 5-Step Action Plan for Handling a Suspicious 58083 Text

If you receive an unsolicited text from 58083 or any other number claiming to be Affirm, do not panic. Follow these five clear, concrete steps.

Step 1: Do Not Engage. Do Not Reply. Do Not Click.

This is the golden rule. Do not click any links, as they can lead to fake websites or install malware. Do not reply, not even with “STOP.” Replying confirms your number is active, making you a target for more scams.

Step 2: Immediately Secure Your Accounts

If you are an existing Affirm customer, go directly to the source. Open a new browser window and manually type in affirm.com or use the official app. Log in, review your account for any unrecognized activity, and change your password immediately.

Step 3: Block the Number and Filter Spam

Block the 58083 short code in your messaging app to prevent further contact. Enable your phone’s built-in spam filtering features to automatically sort messages from unknown senders.

Step 4: Report the Scam to the Authorities

Reporting is a powerful step.

- Your Phone Carrier: Forward the unwanted text message to 7726 (SPAM). This is a free service that helps carriers improve their spam filters.

- The Federal Trade Commission (FTC): File a report at ftc.gov. This data is used by law enforcement to investigate and prosecute scammers.

- Affirm: Go to Affirm’s official Help Center and use their form to “Report unauthorized Affirm account or loan.” This creates a formal paper trail that is critical if you need to dispute fraudulent charges later.

Step 5: Proactively Monitor Your Identity and Credit

An unsolicited code is a warning that your personal information may be compromised. Check your free credit reports from Equifax, Experian, and TransUnion at AnnualCreditReport.com. For maximum protection, consider placing a free one-year fraud alert or a more restrictive credit freeze on your files.

Frequently Asked Questions

Can I just reply “STOP” to a 58083 text message?

It is not recommended. Scammers do not honor “STOP” requests. Replying only confirms your number is active, which can lead to more scam attempts. The safest action is to not reply, block the number, and report the message.

What if I don’t have an Affirm account but still get these texts?

This is very common and is likely caused by a simple typo from a real user or a recycled phone number. While the cause is likely harmless, you must still treat the message as a potential scam attempt. Never share the code, and simply delete and block the message.

Does Affirm know that the 58083 short code is being used for scams?

Yes. Affirm’s official Help Center has pages that address unrequested PINs and explicitly warn users that the company will never ask for a verification code. They are actively investigating these fraudulent activities.

How can I find out who owns a short code?

You can try using an online resource like the U.S. Short Code Directory. However, these directories may not always be up-to-date. The content of the message itself is often a more current clue, but all unsolicited messages should be treated with the same high degree of caution.

Conclusion

In our digital world, your phone number is a key to your financial identity. The 58083 text message, while potentially legitimate, is deeply enmeshed with the dangerous affirm text scam. Your best defense is a healthy and unwavering sense of skepticism. The appearance of an unsolicited verification code is not a reason to panic; it is a signal to be vigilant.

The single most important takeaway is this: Never, under any circumstances, share a verification code that you did not personally and actively request just seconds before.

Financial scams thrive when people stay silent. Protect your friends and family by breaking that silence. Share this article to provide the clarity someone needs to recognize a scam, take the right actions, and save themselves from the devastating consequences of identity theft.