In today’s digital age, smartphones are more than just communication tools; they’re central hubs for work, entertainment, and capturing life’s precious moments. Protecting these valuable devices is paramount. This guide delves into the world of T-Mobile insurance, empowering you to understand the different options available, identify the plan that best aligns with your needs, and leverage the features that can keep your phone safe and secure.

Demystifying T-Mobile: A Diverse Service Portfolio

T-Mobile goes beyond just mobile phone service. Here’s a quick overview of their core offerings:

- Mobile Network:T-Mobile boasts a nationwide mobile network offering talk, text, and data plans for individual users and families.

- Home Internet:T-Mobile offers various home internet options, including fixed wireless internet and 5G internet access in select areas.

- Streaming Services:T-Mobile customers can access exclusive discounts or bundled packages with popular streaming services like Netflix or Hulu.

- Device Financing:T-Mobile provides financing options for purchasing smartphones and other mobile devices.

Unveiling the T-Mobile Insurance Options: Protection Tailored for You

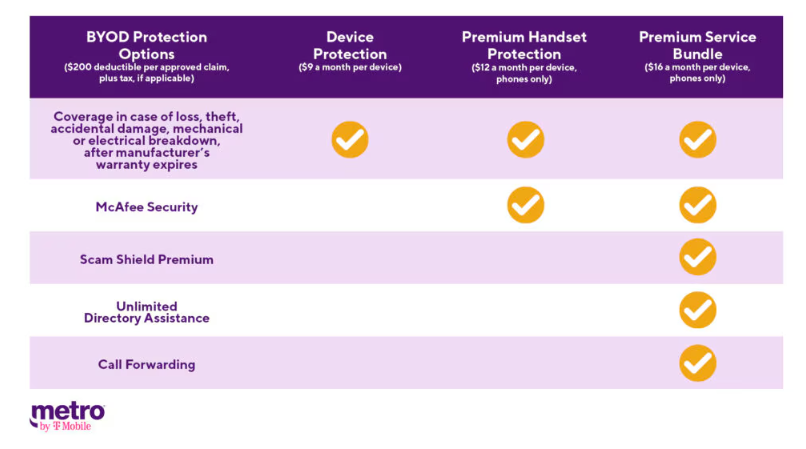

T-Mobile recognizes that “one size fits all” doesn’t apply to phone insurance. Here’s a breakdown of the primary T-Mobile insurance plans currently available:

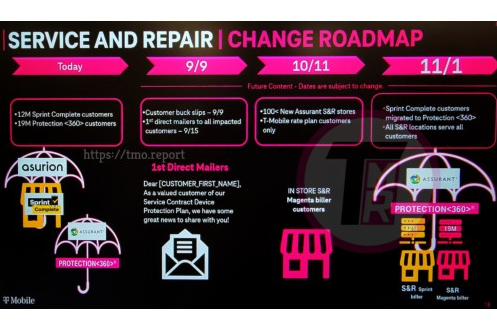

- T-Mobile Protection 360(formerly known as Asurion Mobile Protection Pack): This comprehensive plan offers protection against accidental damage, mechanical breakdowns (hardware malfunctions not caused by accidents), loss, and theft. It also includes screen repair coverage for a deductible.

-

t mobile insurance T-Mobile Basic Protection(formerly known as Basic Device Protection): This more affordable option covers accidental damage and loss or theft, but excludes mechanical breakdowns. Screen repair is also subject to a deductible.

TMobile Basic Protection Plan

Important Considerations:

- Both plans require a monthly premium added to your T-Mobile bill.

- Deductibles apply for certain claims, such as screen repairs or device replacements.

- Both plans offer the option to file claims online, via the T-Mobile app, or by calling a dedicated customer service line.

Choosing the Right T-Mobile Insurance: A Needs-Based Approach

With two primary options available, selecting the right T-Mobile insurance plan boils down to your risk tolerance and budget. Here’s a framework to simplify your decision-making process:

- Accident Prone:If you’re prone to dropping your phone or have a history of accidental damage, T-Mobile Protection 360 offers more comprehensive coverage, including protection against mechanical breakdowns.

- Budget-Conscious:If you handle your phone with care and prioritize affordability, T-Mobile Basic Protection might be a suitable option, providing coverage for accidental damage, loss, and theft.

- New vs. Pre-Owned Device:For brand new flagship smartphones, T-Mobile Protection 360’s comprehensive coverage might provide greater peace of mind. For pre-owned devices or older models, T-Mobile Basic Protection could be sufficient.

Additional Considerations:

- Frequency of Upgrades:If you upgrade your phone frequently, consider the potential cost of deductibles with each claim. Opting for a more comprehensive plan like T-Mobile Protection 360 might be cost-effective if you replace your phone often due to accidental damage.

- Peace of Mind:Factor in the value of peace of mind. If the potential for loss, theft, or unexpected breakdowns worries you, T-Mobile Protection 360’s broader coverage might be worth the additional monthly premium.

Beyond the Plans: Additional Features and Benefits

T-Mobile Insurance goes beyond just replacing a broken phone. Here are some key features to leverage for enhanced protection:

- Jump! (Early Upgrade Program):With T-Mobile Protection 360, you might be eligible for Jump! which allows you to upgrade to a new device after paying a portion of the remaining balance on your current phone, even if it’s damaged. (Subject to eligibility requirements)

- Scam Blocker:Both T-Mobile insurance plans come with built-in Scam Blocker, a valuable tool to help protect you from unwanted robocalls and scam phone numbers.

- Mobile Security App:Access to a mobile security app offering features like remote device wipe and lost/stolen phone location tracking might be included.

Understanding Deductibles and Claims Process

Before enrolling, familiarize yourself with the deductibles associated with each T-Mobile insurance plan. These deductibles are the out-of-pocket costs you’ll be responsible for when filing a claim these deductibles are the out-of-pocket costs you’ll be responsible for when filing a claim for a damaged, lost, or stolen phone. Here’s a breakdown of the claims process:

- Filing a Claim:Claims can typically be filed online, via the T-Mobile app, or by calling a dedicated customer service line.

- Required Documentation:Be prepared to provide proof of purchase for your phone, your T-Mobile account information, and a police report if your phone was stolen.

- Claim Processing Time:Processing times can vary depending on the complexity of the claim and T-Mobile’s workload. However, you can expect a resolution within a few business days for most claims.

- Replacement Options:Depending on the plan and claim type, you might have the option to receive a refurbished replacement device, a brand new device (upon paying the applicable deductible), or opt for mail-in repair services.

Beyond T-Mobile Insurance: Exploring Third-Party Options

While T-Mobile insurance offers convenient protection plans, consider exploring third-party phone insurance providers. Here’s a balanced perspective:

- Potential Cost Savings:Third-party providers might offer similar coverage at a lower monthly premium compared to T-Mobile insurance plans.

- Flexibility:Third-party providers might offer a wider range of plan options with varying coverage levels and deductibles, allowing for a more customized approach.

- Filing Claims:The claims process might differ from T-Mobile’s, so carefully review the terms and conditions of any third-party insurance provider before enrolling.

Important Considerations:

- Compatibility:Ensure the third-party insurance provider covers the specific make and model of your phone.

- Network Compatibility:If you switch mobile carriers in the future, a third-party insurance plan might not be valid on a different network.

The Verdict: Owning Your Choice – Informed Decision Making

Ultimately, the decision of whether to choose T-Mobile insurance or explore third-party options rests with you. Here’s a framework to empower your choice:

- Convenience:If you value the convenience of bundled billing and seamless claims processing within the T-Mobile ecosystem, T-Mobile insurance might be the preferred choice.

- Cost-Effectiveness:If budget is a primary concern, compare pricing and coverage details of third-party providers to potentially find a more cost-effective solution.

- Coverage Needs:Evaluate your risk tolerance and desired level of coverage. If comprehensive protection is a priority, T-Mobile Protection 360 might be ideal. For basic coverage, explore third-party options or T-Mobile Basic Protection.

The Future of Phone Insurance: Embracing Innovation

The phone insurance landscape is constantly evolving. Here’s a glimpse into what the future might hold:

- Customized Coverage:Expect more granular coverage options allowing users to tailor insurance plans to their specific needs, potentially including coverage for specific types of accidental damage or loss.

- Preventative Measures:Insurance providers might integrate preventative measures like screen protector discounts or device security features into their plans.

- Tech Integration:Advanced technologies like AI-powered damage assessments or same-day phone replacements could become more prevalent.

Conclusion: Safeguarding Your Mobile Lifeline – Invest Wisely

By understanding the nuances of T-Mobile insurance, exploring third-party options, and carefully considering your needs and budget, you’re well-equipped to make an informed decision about protecting your valuable smartphone. Remember, phone insurance offers peace of mind and minimizes financial burdens in case of unexpected damage, loss, or theft. As technology evolves, expect phone insurance to adapt and offer even more comprehensive and personalized protection for your connected world.