Executive Context

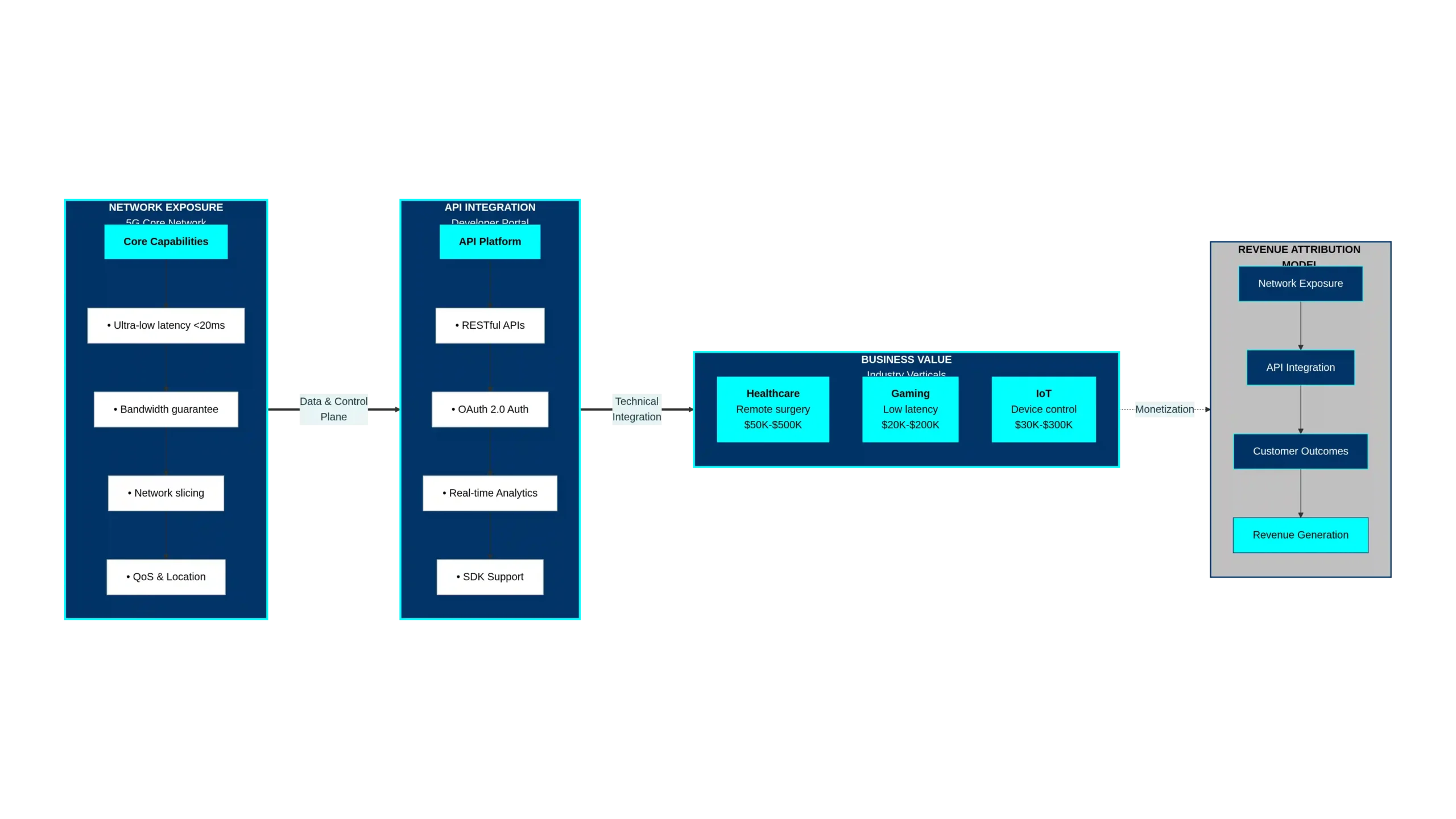

As the industry moves toward 5G Network API Monetization, operators must focus on technical implementation”The telecommunications industry stands at a crossroads where 5G Network API Monetization represents the primary driver for future growth. at an inflection point. While 5G infrastructure investment has exceeded $2 trillion globally, revenue generation remains constrained by commodity connectivity pricing. Network APIs represent a fundamental pivot: operators expose network capabilities—quality-of-service control, network slicing, location verification, identity management—through programmable interfaces, enabling third-party developers to build applications that generate sustainable, scalable revenue.commsbrief+1

“While unlocking new revenue streams is vital, ensuring the integrity of these interfaces is equally important. You can explore the protection side in our detailed guide on 5G Network API Security.”

However, monetization failure rates remain high. Research from Analysys Mason indicates that only 51% of telecom operators consider themselves API-ready, despite 47 major operator groups representing 65% of global connections committing to standardized network APIs through GSMA Open Gateway. The gap between technical launch and revenue realization stems from two critical failures: inadequate developer experience optimization and poorly architected revenue attribution models.abiresearch+1

This technical guide addresses both dimensions, providing CTOs and platform architects with actionable frameworks bridging engineering implementation and commercial viability.

“The NEF doesn’t just manage monetization; it is the primary gateway for defense. To understand how to harden this function, check out our analysis of 5G Network API Security.”

PART I: DEVELOPER EXPERIENCE OPTIMIZATION FRAMEWORK

1. The Developer Readiness Gap

Telecom network APIs fundamentally differ from consumer web APIs (Twilio, Vonage, Stripe) that have successfully scaled to millions of developers. Traditional web API success factors—instant API key provisioning, comprehensive documentation, lightweight integration requirements—conflict with telecom network complexity: legacy system constraints, security demands, multi-operator orchestration requirements, and unfamiliar technical abstractions.

Current industry data reveals the magnitude of this gap:telecomramblings+2

-

Documentation sufficiency: Only 44% of developers report comprehensive, usable network API documentation versus 89% satisfaction with cloud API documentation (AWS, Google Cloud, Azure)

-

Sandbox availability: 67% of telecom operators lack production-equivalent sandbox environments; 81% of developers cite this as adoption barrier

-

Skill matching: 58% of application developers lack telecom network protocol familiarity; steep learning curves deter 73% of potential adopters

-

Integration complexity: Average integration timeline for network APIs: 8-12 weeks; equivalent CPaaS integration: 1-2 weeks

-

Support responsiveness: Median time-to-resolution for telecom API support: 72 hours; cloud API support: 4-8 hours

2. Developer Experience Optimization Blueprint

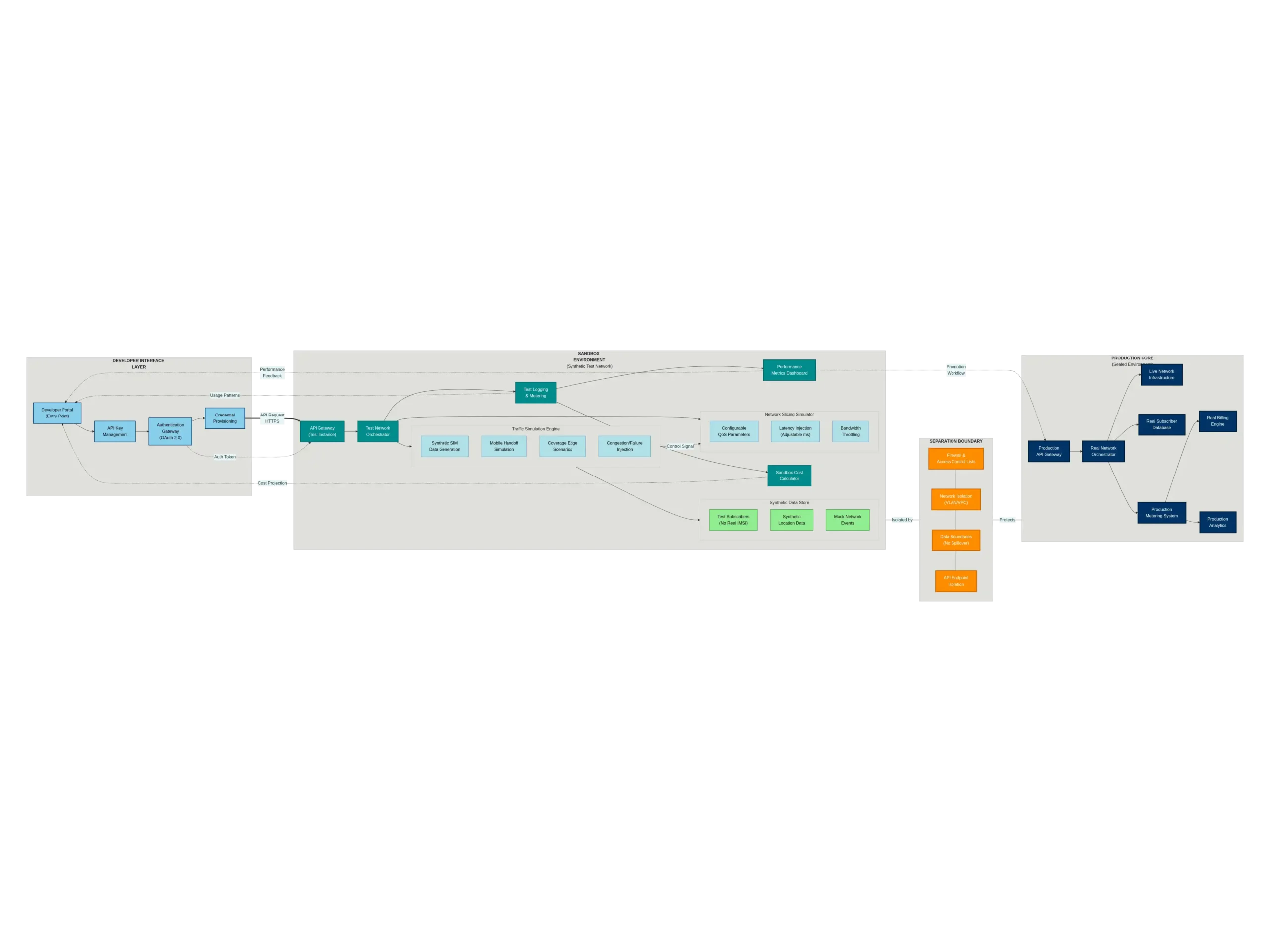

A. 5G Network API Monetization Sandbox Architecture

“A robust sandbox is essential for any successful 5G Network API Monetization strategy. Production-equivalent sandboxes are non-negotiable for API monetization success. Developers require environments where they can experiment without financial liability, test error conditions, and validate performance characteristics before production commit.lotusflare+2

Implementation specification:

├─ Data Isolation

│ ├─ Segregated test networks (no real SIM cards, IMSI, or phone numbers)— developers can simulate device identities without needing a physical device; for more on how these IDs work, see our guide on [understanding device identity and IMEI codes].”

│ ├─ Synthetic traffic generation mimicking real network conditions

│ └─ GDPR-compliant synthetic personally identifiable information (PII)

├─ Feature Parity

│ ├─ 100% API endpoint coverage matching production

│ ├─ Network slicing simulation with configurable QoS parameters

│ ├─ Location services with synthetic location data streams

│ └─ Authentication flows (OAuth 2.0 with test credentials)

├─ Traffic Simulation

│ ├─ Network congestion modeling (adjustable latency, packet loss)

│ ├─ Mobile network handoff simulation

│ ├─ 5G coverage edge scenarios

│ └─ Failure injection (rate limiting, timeout scenarios)

├─ Performance Measurement

│ ├─ Request/response latency metrics

│ ├─ Throughput characterization (calls per second capacity)

│ └─ Cost projection (simulated billing output)

└─ Compliance Boundaries

├─ Rate limiting (soft limits for learning phase)

└─ Security constraints (OAuth scopes, no real authorization)

Benchmark comparison: Leading CPaaS providers (Twilio, Vonage) provision sandbox access within 5 minutes of account creation. Telecom operators currently require 48-72 hours of manual provisioning. Target: 15-minute automated provisioning through self-service developer portal.

B. Technical Documentation Strategy

Network API documentation must bridge two audiences: experienced software developers unfamiliar with telecom concepts, and telecom specialists unfamiliar with modern API design patterns. Generic API documentation template approach fails both segments.

Recommended structure (per API endpoint):

1. CONCEPTUAL OVERVIEW (300-400 words)

├─ Problem statement (what business challenge does this API solve?)

├─ Use cases (3-5 concrete examples by industry vertical)

├─ Telecom concept explanation (demystifying network abstractions)

└─ Competitive context (how does this compare to alternatives?)

2. QUICK START GUIDE (15-minute implementation)

├─ Prerequisites (authentication setup, required scopes)

├─ 5-line minimal code example (Python, Node.js, Java)

├─ cURL request/response example

├─ Expected latency characteristics

└─ Common error codes with resolution steps

3. TECHNICAL REFERENCE

├─ Request/response schema (OpenAPI 3.0 format)

├─ Required/optional parameters with constraints

├─ Authentication flow (OAuth 2.0 specifics)

├─ Rate limiting policies

├─ SLA characteristics (latency p50/p99, availability)

└─ Billing/metering implications

4. Strategic 5G Network API Monetization Implementation Patterns

├─ Retry logic (exponential backoff strategies)

├─ Error handling (with code examples)— Proper error handling is crucial for developer retention; you can review our [technical guide on fixing web fetch errors] for more insights.”

├─ Webhook integration (async notification patterns)

├─ Batch operations (when available)

└─ Performance optimization (minimizing API calls)

5. INDUSTRY-SPECIFIC INTEGRATIONS

├─ Healthcare use case (HIPAA compliance implications)

├─ Manufacturing use case (latency-critical scenarios)

├─ Financial services use case (fraud detection patterns)

└─ Public safety use case (priority access integration)

6. TROUBLESHOOTING & SUPPORT

├─ Common failure modes with diagnosis

├─ Network debugging techniques

├─ Cost optimization guidance

├─ Performance profiling tools

└─ Community forum links, support escalation path

Documentation quality metrics:

| Metric | Telecom Current | CPaaS Benchmark | Target |

|---|---|---|---|

| Time-to-first-API-call | 8-12 hours | 15-20 minutes | 30 minutes |

| Code example coverage | 2-3 languages | 8+ languages | 6+ languages |

| Real-world use cases | 0-1 | 5-10 | 5+ per API |

| Update frequency | Quarterly | Per release (weekly+) | Per release |

| Community contributions | <5% | 15-20% | 10%+ |

| Average satisfaction rating | 3.8/5 | 4.7/5 | 4.5+/5 |

C. Software Development Kit (SDK) Strategy

Telcos typically expose network APIs as REST endpoints with minimal SDK support. Modern developers expect language-specific SDKs abstracting protocol complexity, handling authentication, managing retries, and instrumenting metrics.

Multi-language SDK implementation priorities (ranked by developer population):

-

Python (Data science, automation, IoT—dominant in enterprise)

-

Node.js/TypeScript (Web services, real-time applications)

-

Java (Enterprise backend systems, mission-critical workloads)

-

Go (Cloud-native applications, microservices)

-

C#/.NET (Windows enterprise ecosystem)

-

Kotlin/Swift (Mobile application development)

SDK feature requirements:

│ ├─ OAuth 2.0 token handling (automatic refresh)

│ ├─ Token caching and lifecycle management

│ └─ Credential rotation support

├─ Resilience Patterns

│ ├─ Automatic retry with exponential backoff

│ ├─ Circuit breaker (fail fast on operator outages)

│ ├─ Request timeout configuration

│ └─ Idempotency key management

├─ Observability Integration

│ ├─ Structured logging (JSON format, searchable)

│ ├─ Distributed tracing (OpenTelemetry support)

│ ├─ Metrics emission (Prometheus format)

│ └─ Error telemetry

├─ Developer Ergonomics

│ ├─ Type-safe API (strong typing, IDE autocomplete)

│ ├─ Fluent API design (method chaining)

│ ├─ Synchronous and async variants

│ └─ Webhook signature validation

└─ Testing Utilities

├─ Mock implementations for unit testing

├─ Test fixture generation

├─ Deterministic sandbox responses

└─ Integration test helpers

Example Python SDK ergonomics comparison:

D. Developer Portal Architecture

The developer portal is the primary interface for API discovery, credential management, usage monitoring, and support escalation. Poor portal design directly correlates with adoption failure.telecomramblings

Portal feature specification:

| Feature | Purpose | CPC Relevance |

|---|---|---|

| API Catalog with Search | Discoverability; enables developers to find relevant APIs | High—reduces time-to-first-implementation |

| Interactive API Documentation | Try-it-now functionality with real API calls | High—reduces sandbox setup friction |

| Credential Management | API key provisioning, rotation, revocation | Essential security |

| Usage Analytics Dashboard | Real-time visualization of API call volume, cost attribution | Critical for revenue model transparency |

| Rate Limit Status | Current quota utilization, reset timings | Prevents bill shock |

| Cost Projection Calculator | Estimated monthly bills based on usage patterns | Risk mitigation for enterprise customers |

| Billing & Invoicing | Detailed usage reports, downloadable invoices | Revenue operations necessity |

| Community Forum | Developer peer support, best practices sharing | Reduces support ticket volume by 40-60% |

| Support Ticket System | Escalation path for technical issues | SLA management |

| Integration Guides | Popular platform/service integrations (Salesforce, SAP, etc.) | Reduces implementation time |

| Monitoring & Alerting | API performance alerts, quota warnings | Proactive operational excellence |

Portal benchmarking (user experience metrics):

| Metric | Requirement | Current Telecom | CPaaS Leader |

|---|---|---|---|

| Time-to-API-key | <5 minutes | 45+ minutes | 2 minutes |

| Search relevance | Top result matches intent | 60% accuracy | 94% accuracy |

| Documentation quality | Usable without external reference | 45% self-sufficient | 92% self-sufficient |

| Support response time | <4 hours for critical issues | 24+ hours | 2-4 hours |

| Portal uptime | 99.9%+ | 97.2% | 99.95%+ |

3. Developer Community Building Strategy

Documentation and tools alone insufficient—network API adoption accelerates through active developer communities where practitioners share solutions, troubleshoot together, and build on each other’s work.lotusflare+1

Community development roadmap (18-month):

Months 1-3: Foundation

-

Launch Slack workspace (40-person target) for API users

-

Create GitHub organization for SDKs, sample code, reference implementations

-

Host bi-weekly “office hours” (live Q&A sessions)

-

Publish monthly “API digest” (best practices, new capabilities)

Months 4-9: Growth

-

Organize hackathon competition ($25K prize pool; ~200-300 participants)

-

Establish “Developer Advisory Board” (10-12 influential community members for feedback)

-

Launch certification program (validate API expertise; drive credibility)

-

Host regional meetups (3-4 cities)

Months 10-18: Ecosystem

-

Establish vendor partner program (integrations with major platforms)

-

Create marketplace for third-party applications (revenue-sharing model)

-

Publish quarterly state-of-the-ecosystem report

-

Expand international community chapters

Success metrics:

-

Community member count: 5,000+ (12-month target)

-

Active monthly contributors to open-source SDK repos: 50+

-

Developer satisfaction (NPS): 45+

-

Support ticket deflection (community-answered): 35%+

PART II: REVENUE ATTRIBUTION FRAMEWORK

4. Monetization Model Selection Framework

“Network API monetization success requires precise alignment between technical architecture, customer value realization, and billing mechanics; for organizations using major carriers, [managing enterprise telecom billing and payments] is a critical component of this alignment.”One-size-fits-all pricing fails because network API value varies drastically by use case.

“Choosing the right model is critical for long-term 5G Network API Monetization success.”

Use case value analysis (illustrates why simple usage-based pricing fails):

| Use Case | Customer | Primary Value Driver | Appropriate Metric |

|---|---|---|---|

| Fraud Detection | Financial Services | Prevents fraud losses (~$1M annually per customer) | Per-transaction reviewed (not API calls) |

| Network Quality Dashboard | Real-time Gaming | Reduces latency-induced churn | Per-active-subscriber (fixed, regardless of API calls) |

| Location Verification | Delivery Service | Enables real-time logistics | Per-delivery-completed (transaction-based) |

| IoT Connectivity Management | Smart City | Scales with device count | Per-connected-device (seat-based) |

| Priority Network Access | Public Safety | Mission-critical reliability | Subscription tier (flat-rate, not usage) |

This demonstrates critical insight: charging purely on API call volume misaligns price with value and reduces revenue potential.monevate

5. Recommended 5G Network API Monetization Pricing Models for Network APIs

Model A: Tiered Subscription (Enterprise Segment)

When appropriate:

-

Customers’ value derives from feature access, not consumption scale

-

Predictable usage patterns

-

Enterprise buyers prefer fixed OpEx budgets

-

Strong competitive differentiation by capability tier

Implementation:

Tier Structure (example: Network Slicing APIs)

BRONZE – $2,500/month

├─ Up to 5 concurrent network slices

├─ Standard latency guarantee (50ms p99)

├─ Email support (24-hour response)

├─ API call limit: 1,000/second

SILVER – $7,500/month

├─ Up to 20 concurrent network slices

├─ Premium latency guarantee (20ms p99)

├─ Phone + email support (4-hour response)

├─ API call limit: 5,000/second

└─ Includes network analytics dashboard

GOLD – $25,000/month

├─ Unlimited concurrent network slices

├─ Ultra-low latency guarantee (5ms p99)

├─ Dedicated support engineer

├─ API call limit: 25,000/second

├─ Custom SLA negotiation

└─ Advanced DDoS mitigation

Revenue attribution: Fixed monthly revenue per customer tier; simple to forecast; encourages tier upgrades as usage grows (natural expansion revenue).

Model B: Hybrid (Base + Overage)

When appropriate:

-

Usage patterns predictable at lower volumes; highly variable at scale

-

Want to retain price simplicity while capturing expansion revenue

-

Target early-stage developers (low friction entry) + established enterprises (meaningful margin)

Implementation:

Hybrid Pricing (example: Location Verification APIs)

Base subscription: $500/month

├─ Includes 1M location queries monthly

├─ Standard latency SLA

└─ Community support

Overage pricing: $0.0002 per query beyond 1M/month

├─ Automatic overage billing

├─ No per-request limits (always available)

└─ Volume discounts:

– 1-5M additional queries/month: $0.0002/query

– 5-20M additional queries/month: $0.00015/query

– 20M+ additional queries/month: $0.0001/query

Enterprise agreement (negotiated)

├─ Minimum 10M queries/month = $1,500/month

└─ Per-query blended rate: $0.00015

Revenue attribution: Base revenue committed; overage revenue grows with customer success; customer sees transparent cost scaling.

Model C: Usage-Based (Per-Event)

When appropriate:

-

Clear per-unit business outcome (transaction, delivery, device)

-

Exact value correlation with consumption metric

-

Low-friction adoption (no upfront commitment)

-

Customer usage unpredictable at sign-up

Implementation:

Usage-Based Pricing (example: Network Quality APIs for Gaming)

Charging metric: Per million API requests

Pricing tiers (with volume discounts):

├─ 0-10M requests/month: $2.50 per million

├─ 10-50M requests/month: $2.00 per million

├─ 50-100M requests/month: $1.50 per million

└─ 100M+ requests/month: $1.00 per million

Minimum bill: None (true pay-as-you-go)

Maximum burst: Unlimited (no rate limiting)

Billing frequency: Monthly (post-usage)

Example calculation:

Customer usage: 35M API calls in January

= 35 × $2.00 (bulk tier rate) = $70 monthly bill

Revenue attribution: Directly metered; transparent to customers; scales with customer success; requires robust usage tracking and fraud prevention.

Model D: Revenue-Sharing (Platform Partnerships)

When appropriate:

-

APIs generate customer revenue rather than cost savings (e.g., CPaaS)

-

Partner incentive alignment critical

-

Multiple revenue tiers possible simultaneously

-

Cloud hyperscaler partnerships (AWS, Azure, Google Cloud)

Implementation:

Revenue Sharing Agreement Structure

TIER 1: Cloud Marketplace Integration (AWS, Azure, Google Cloud)

├─ Operator APIs available through cloud provider marketplace

├─ Cloud provider extracts 10% transaction fee

├─ Operator receives 90% of end-customer payments

└─ Example: Developer pays $100 for API access

– Cloud provider: $10

– Operator: $90

TIER 2: Enterprise Reseller (Systems Integrators, Managed Service Providers)

├─ Reseller offers complete solution (operator API + custom integrations)

├─ Revenue split: 70% reseller / 30% operator (negotiable)

├─ Minimum annual commitment: $50K

└─ Example: Reseller generates $200K annual customer revenue

– Reseller: $140K

– Operator: $60K

TIER 3: Technology Partnerships (Analytics, Security, Telecom Management)

├─ Strategic partner integrates operator APIs into platform

├─ Revenue share: 40% operator / 60% partner (aligned with partner’s value addition)

├─ Joint marketing commitment required

└─ Example: Partner generates $500K annual customer revenue

– Partner: $300K

– Operator: $200K

Revenue attribution: Multi-tiered, requires partner relationship management and revenue reconciliation automation; incentivizes partner growth investment.

6. Revenue Attribution Implementation Architecture

Pricing model selection insufficient without supporting systems infrastructure. Revenue attribution requires real-time usage tracking, accurate billing calculations, and transparent reporting.

System architecture specification:

USAGE DATA PIPELINE

API Gateway Layer (Envoy, Kong)

├─ Capture request metadata

│ ├─ API endpoint (identifies billing metric)

│ ├─ Customer ID (identifies account, pricing tier)

│ ├─ Request timestamp

│ ├─ Response status (successful, throttled, error)

│ └─ Response size (for bandwidth-based charging)

└─ Route to metering system asynchronously

Metering Service (Specialized Usage-Based Billing)

├─ Function: Aggregate usage events into billable metrics

├─ Process:

│ ├─ Deduplication (prevent duplicate charges from retries)

│ ├─ Validation (reject malformed/fraudulent events)

│ ├─ Aggregation (hourly/daily buckets)

│ └─ Scoring (apply pricing tier, volume discounts)

├─ Data retention: 3 years (regulatory requirement)

└─ Latency requirement: <5 second event-to-billing (near-real-time)

Billing Engine Integration

├─ Ingest aggregated usage metrics

├─ Apply pricing logic (tier, discounts, minimums)

├─ Generate invoice line items

├─ Interface with accounting system (AR)

└─ Monthly cycle: Finalize, invoice, collect

Customer Dashboard (Self-Service Analytics)

├─ Real-time usage visibility

├─ Cost projection (month-to-date + forecast)

├─ API performance metrics

├─ Budget alerts (threshold-based notifications)

└─ Historical reporting (12-month view)

Fraud Detection System

├─ Identify suspicious usage patterns

│ ├─ Sudden 10x traffic spike (compromised credentials)

│ ├─ Geographic inconsistency (API call from unexpected location)

│ ├─ Automated bot detection

│ └─ Repeated failed authentication attempts

├─ Automated response: Rate-limit suspicious accounts

└─ Manual escalation: Security team investigation

Technical stack example (production-grade):

| Component | Technology | Rationale |

|---|---|---|

| API Gateway | Envoy Proxy + Twistlock | Request interception + security |

| Metering | Kafka + Faust | High-throughput event streaming |

| Storage | ClickHouse | OLAP database; 100B+ events/day capacity |

| Billing | Stripe Billing + Custom Logic | Subscription management + network API specialization |

| Dashboards | Grafana + Custom Frontend | Real-time visualization |

| Analytics | BigQuery | Long-term trend analysis, customer segmentation |

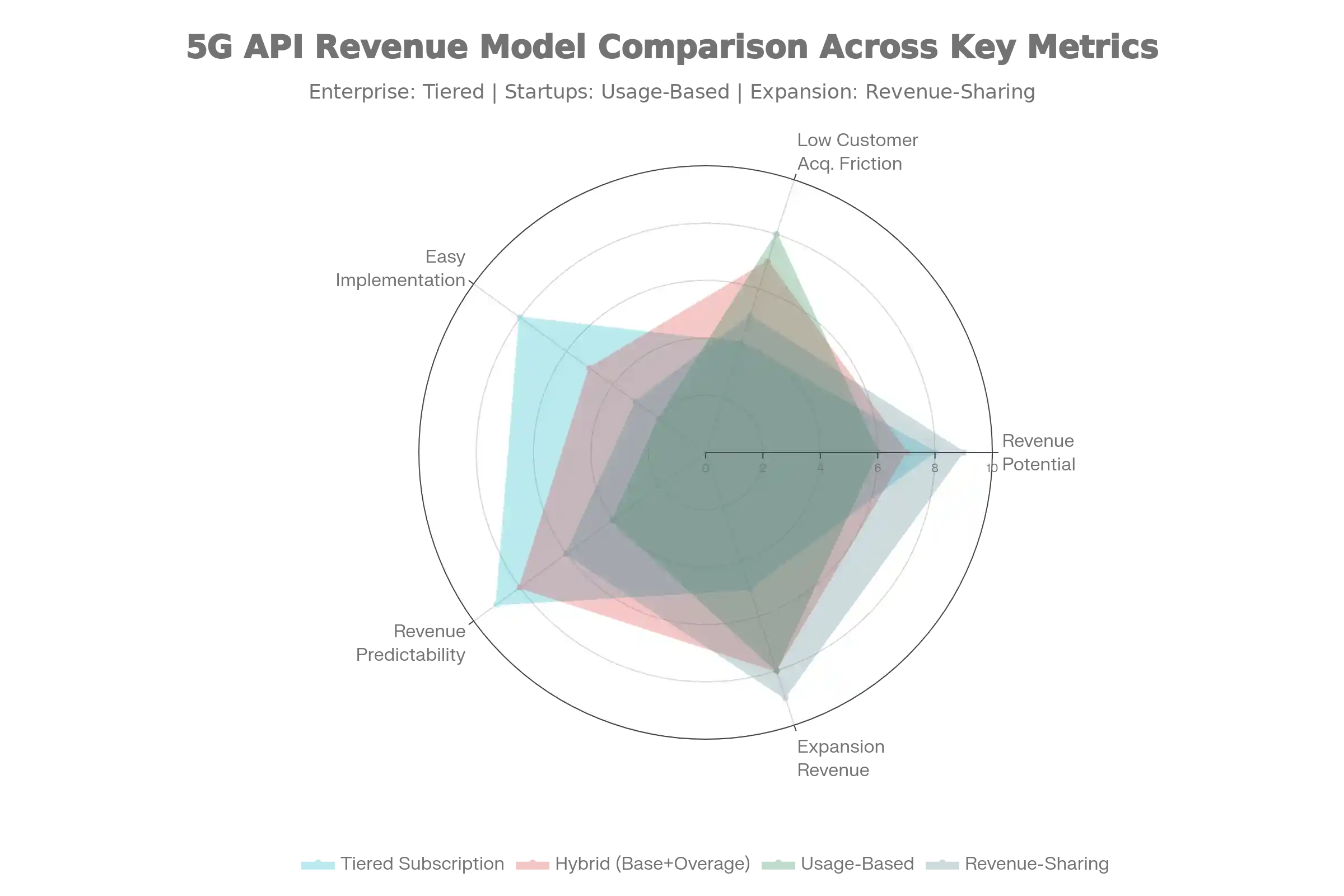

7. Detailed Pricing Model Comparison Matrix

This matrix aids CTO decision-making by quantifying trade-offs across implementation complexity, revenue potential, and customer experience.

| Dimension | Tiered Subscription | Hybrid (Base+Overage) | Usage-Based | Revenue-Share |

|---|---|---|---|---|

| Implementation Complexity | Low (simple, legacy-compatible) | Medium (metering + tiers) | High (real-time metering + fraud detection) | High (partner accounting) |

| Billing System Requirements | Standard subscription engine | Standard + metering | Specialized usage-based platform | Custom reconciliation |

| Revenue Predictability | Very High (fixed contracts) | High (base committed) | Low (depends customer usage) | Medium (partner-dependent) |

| Customer Acquisition Friction | Medium (upfront commitment required) | Low (no minimum spend) | Very Low (pure pay-as-you-go) | Medium (partnership negotiation) |

| Expansion Revenue Potential | Medium (tier upgrades) | High (overage + upgrades) | High (usage growth) | Very High (partner scale) |

| Revenue per Customer | High ($2.5K-$25K+/month typical) | Medium-High ($500-$5K typical) | Variable ($100-$10K+/month) | High (partner-scaled) |

| Customer Lifetime Value (CLV) | Very High (annual contracts, sticky) | High (switching cost moderate) | Medium (low switching cost) | Very High (deep integration) |

| Churn Risk | Low (contractual commitment) | Medium (perceived value critical) | High (performance sensitivity) | Low (mutual benefit) |

| Suitable Customer Segment | Enterprise (predictable budgets) | Mixed (SMB + Enterprise) | Startups + Innovators | Strategic Partners |

| Example Operator Implementation | Vonage (tiered CPaaS plans) | Twilio (base SMS + overage) | AWS API Gateway | GSMA Open Gateway |

8. Customer Segmentation for Pricing Optimization

One operator, multiple pricing models—strategic operators apply different pricing to distinct customer segments based on use case, value realization, and willingness-to-pay.monevate

Segmentation matrix (example: Network Slicing APIs):

SEGMENT 1: ENTERPRISE MISSION-CRITICAL (Healthcare, Finance, Public Safety)

├─ Characteristics:

│ ├─ High latency sensitivity (requires <20ms p99 guarantee)

│ ├─ Mission-critical workloads (cannot accept service interruption)

│ ├─ Regulated industry (HIPAA, PCI-DSS compliance)

│ └─ Large annual IT budgets

├─ Pricing Model: Premium Tiered Subscription

├─ Example Annual Revenue: $300K/customer

├─ Customer Acquisition Cost: $50-75K

├─ Support: Dedicated engineer, 1-hour response SLA

└─ Go-to-Market: Enterprise sales, solution architecture

SEGMENT 2: HIGH-GROWTH STARTUPS (Gaming, IoT, Logistics)

├─ Characteristics:

│ ├─ Usage highly variable/unpredictable

│ ├─ Budget constraints (limited capital)

│ ├─ Rapid scaling potential (10x growth possible)

│ └─ Performance-sensitive but not life-critical

├─ Pricing Model: Hybrid (Low base + volume discounts)

├─ Example Annual Revenue: $50-500K/customer (wide range)

├─ Customer Acquisition Cost: $5-15K

├─ Support: Community + email support

└─ Go-to-Market: Developer marketing, partnerships with accelerators

SEGMENT 3: PLATFORM/MARKETPLACE (Cloud providers, integration platforms)

├─ Characteristics:

│ ├─ Very high transaction volume

│ ├─ Multi-tenant (many end-customers)

│ ├─ Standard procurement processes

│ └─ Long sales cycles but massive deal values

├─ Pricing Model: Revenue-Share + Volume Discounts

├─ Example Annual Revenue: $5M+ per partner

├─ Customer Acquisition Cost: $200-500K (selling + integration)

├─ Support: Technical integration team, quarterly business reviews

└─ Go-to-Market: Strategic partnerships, co-go-to-market campaigns

SEGMENT 4: INTERNATIONAL RESELLERS (Systems Integrators, Telecom Consultancies)

├─ Characteristics:

│ ├─ Multi-country operations

│ ├─ 50-500+ end customers each

│ ├─ Local market expertise

│ └─ Bundled solutions (APIs + consulting + implementation)

├─ Pricing Model: Reseller Margin (30-40% discount to retail)

├─ Example Annual Revenue: $200K-2M per reseller

├─ Customer Acquisition Cost: $10-25K

├─ Support: Reseller enablement, certification program

└─ Go-to-Market: Channel partner program, co-selling

9. Cost Attribution & Profitability Analysis

CPOs and finance teams require transparent understanding of API cost-to-serve for margin analysis.

Cost structure specification (annual):

COST COMPONENTS

1. INFRASTRUCTURE COSTS

├─ API Gateway/Load Balancing: $500K annually

│ ├─ Includes 5x redundancy, global edge locations

│ └─ Scales to 100K concurrent users

├─ Metering/Billing System: $300K annually

│ ├─ Usage-based platform (Amberflo, Stripe Billing, custom)

│ └─ Handles 10B+ events/month

├─ Data Storage (usage events): $150K annually

│ └─ 3-year retention, queryable for audit/analytics

└─ Network Egress (API responses): Variable ($0.10/GB egress)

2. PERSONNEL COSTS

├─ Product Management (1 FTE): $200K/year

├─ Engineering (4 FTE): $800K/year

│ ├─ 2x backend engineers (API infrastructure, billing integration)

│ ├─ 1x frontend engineer (developer portal, dashboards)

│ └─ 1x DevOps/SRE (reliability, observability)

├─ Developer Relations (2 FTE): $300K/year

│ ├─ Community management, documentation

│ └─ Developer advocate (technical marketing)

├─ Support (2 FTE part-time): $200K/year

│ └─ Escalation support, technical consultations

└─ Finance/Billing Operations (1 FTE): $150K/year

3. MARKETING & SALES

├─ Content/Technical Marketing: $150K/year

├─ Paid demand generation: $200K/year

│ └─ LinkedIn, industry events, sponsorships

├─ Sales enablement: $100K/year

└─ Partner/Channel programs: $100K/year

4. COMPLIANCE & SECURITY

├─ Security audits (SOC 2 Type II, ISO 27001): $200K/year

├─ Regulatory compliance (GDPR, CCPA): $100K/year

└─ Penetration testing: $100K/year

TOTAL ANNUAL COST: $4,150K (baseline)

Cost per customer (varies by customer tier):

├─ Enterprise customer ($300K annual revenue): COGS = ~$45K (15% margin)

├─ Mid-market customer ($50K annual revenue): COGS = ~$5K (90% margin)

└─ Startup customer ($10K annual revenue): COGS = ~$1.5K (85% margin)

Profitability analysis (illustrative portfolio):

Customer Portfolio Example (Year 1)

ENTERPRISE TIER (5 customers)

├─ Revenue: 5 × $300K = $1,500K/year

├─ COGS (infrastructure + support): 5 × $45K = $225K

├─ Gross margin: 85%

└─ Contribution: $1,275K

MID-MARKET TIER (20 customers)

├─ Revenue: 20 × $50K = $1,000K/year

├─ COGS (infrastructure + minimal support): 20 × $5K = $100K

├─ Gross margin: 90%

└─ Contribution: $900K

STARTUP TIER (100 customers)

├─ Revenue: 100 × $10K = $1,000K/year

├─ COGS (infrastructure only): 100 × $1.5K = $150K

├─ Gross margin: 85%

└─ Contribution: $850K

TOTAL REVENUE: $3,500K

TOTAL CONTRIBUTION: $3,025K

FIXED COSTS: $4,150K

EBITDA: -$1,125K (Year 1 investment phase)

Breakeven analysis:

├─ Contribution per revenue dollar: $0.864 (86.4%)

├─ Required revenue for breakeven: $4,800K annually

├─ Customer count at breakeven: ~100-150 customers (mixed tier portfolio)

└─ Timeline to profitability: 18-24 months (with scale)

This analysis demonstrates why customer segmentation critical: enterprises (15% margin) cross-subsidize startups (85% margin) in portfolio; overall margin supports growth investment.

CONCLUSION: INTEGRATION STRATEGY

“In summary, achieving excellence in 5G Network API Monetization requires a focus on developer experience and revenue attribution.”

requires simultaneous optimization across three dimensions:

-

Developer Experience Excellence: Removes adoption friction; reduces implementation time from months to weeks; expands addressable developer market

-

Revenue Attribution Accuracy: Aligns pricing with customer value; enables profitable scaling; supports expansion revenue

-

Operational Excellence: Automates billing, enables self-service, provides transparency; reduces support costs

Leading operators (Vonage, Deutsche Telekom, Orange) targeting $50M+ annual network API revenue by 2027 have committed to multi-year investments spanning infrastructure modernization ($50-100M), developer experience buildout, and revenue operations sophistication.

CTOs implementing these frameworks position organizations to capture the $13.4B network API opportunity by 2030—requiring immediate action given the 18-24 month implementation timeline.

“Next Step in Your 5G Journey: Now that you understand the business models, ensure your infrastructure is resilient against threats by reading our latest post: 5G Network API Security: Challenges and Solutions.”

References & Data Sources:

-

Developer experience gaps and adoption barriers:avidthink+3

-

CPaaS provider benchmarking (Twilio, Vonage comparison):callin+4

-

Revenue attribution models and pricing strategies:payproglobal+7

-

Telecom network API market forecasts:commsbrief+1

-

5G monetization frameworks:neuralt+2

-

Usage-based billing implementation:rately+3

5G Network API Monetization Resources

- https://commsbrief.com/how-network-apis-could-unlock-300-billion-in-5g-revenue-the-strategic-framework-every-operator-needs/

- https://www.neuralt.com/news-insights/apis-and-ai-enabling-monetization-opportunities-in-telecom

- https://www.abiresearch.com/blog/telcos-revisit-network-apis-to-drive-5g-monetization

- https://www.telecomramblings.com/2025/03/unlocking-the-potential-of-network-apis-relevance-challenges-and-the-path-forward/

- https://www.avidthink.com/p/telcos-finally-cracking-api-code

- https://lotusflare.com/blog/navigating-network-api-ecosystem/

- https://www.5gamericas.org/wp-content/uploads/2024/11/The-Programmable-5G-Network-and-API-Ecosystem.pdf

- https://www.monevate.com/blog/monetizing-apis-one-of-saass-biggest-revenue-opportunities

- https://callin.io/twilio-vs-vonage/

- https://globaldev.tech/blog/twilio-vs-nexmo

- https://www.simform.com/blog/twilio-vs-vonage-nexmo/

- https://www.cxtoday.com/customer-analytics-intelligence/twilio-vs-vonage-a-comparison-of-two-cpaas-giants/

- https://www.zegocloud.com/blog/twilio-vs-vonage

- https://payproglobal.com/answers/what-is-saas-api-monetization/

- https://www.digitalapi.ai/blogs/api-monetization-models

- https://terem.tech/mapping-api-use-cases-to-monetisation-models/

- https://www.moesif.com/blog/developer-platforms/api-analytics/How-To-Monetize-Your-APIs-Choosing-Your-API-Monetization-Stack/

- https://www.analysysmason.com/contentassets/df4fe4a3e0fe4dfe8a3e54f757bb6007/analysys_mason_npaas_5g_apis_apr2023_rdmv0_rma04.pdf

- https://rately.dev/blog/saas-apis-usage-based-billing-rately/

- https://www.cyient.com/blog/cracking-the-5g-code-monetizing-networks-through-exposure

- https://www.ericsson.com/en/enterprise/network-apis

- https://flexprice.io/blog/how-to-implemement-usage-based-billing-for-saas

- https://schematichq.com/blog/why-usage-based-billing-is-taking-over-saas

- https://www.ledgerup.ai/resources/ultimate-guide-to-usage-based-billing-2025-ledgerup-platform

- https://developer.vonage.com/en/home

- https://developer.vonage.com/en/blog/migration-from-twilio-to-vonage-video-guides-for-web-ios-android

- https://www.twilio.com/en-us

- https://kloud7.com/cpaas/

- https://www.plivo.com/blog/twilio-vs-vonage/

- https://emitrr.com/blog/bandwidth-alternative/

- https://www.g2.com/compare/bandwidth-bandwidth-vs-vonage-communications-apis

- https://knock.app/blog/the-top-sms-providers-for-developers

- https://sourceforge.net/software/compare/Nexmo-vs-Syniverse-CPaaS-Concierge/

- https://dev.to/vonagedev/vonage-dev-newsletter-april-2024-say-hello-to-vonage-network-apis-1kmc

- https://www.ericsson.com/en/reports-and-papers/white-papers/global-network-api-platform-to-monetize-5g

- https://www.telekom.com/en/media/media-information/archive/global-telecom-leaders-join-forces-to-redefine-the-industry-with-network-apis-1077720

- https://docs.broadcom.com/doc/the-service-innovation-mandate-in-telecommunications

- https://www.reddit.com/r/SaaS/comments/1b2ti4x/usagebased_pricing_option/

- https://flexprice.io/blog/what-is-the-best-usage-based-billing-solution-for-a-saas-ai-company

- https://www.idibilling.com/wp-content/uploads/IDI_Monetizing_5G_eBook_040825.pdf