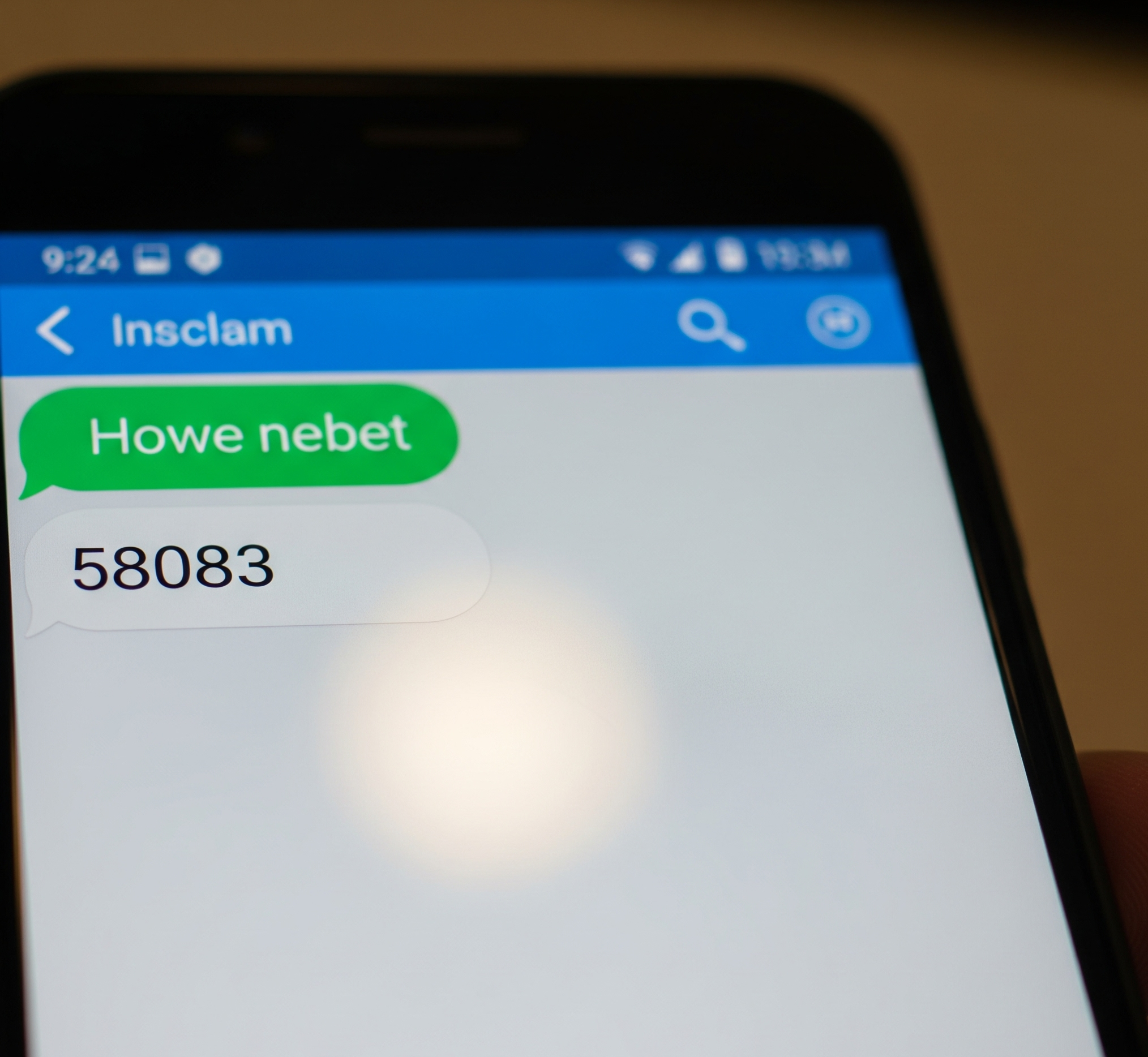

A text message suddenly appears from a five-digit number like 58083. It mentions Affirm and includes a verification code you never requested. Immediately, questions arise: Is this a legitimate alert? Is my account in danger? Is this a scam?

If you’ve received an unexpected 58083 Affirm text, you are not alone. This guide will walk you through everything you need to know. We’ll explain why you received the message, how to determine if it’s a sophisticated scam, and the exact steps to take to protect your financial information.

The single most important rule to remember is this: Affirm will never ask you for your PIN, password, or verification code over the phone, text, or email. Any message that asks for this information is fraudulent.

Why Did I Get a Text From 58083? The Technology Explained

To understand the text from 58083, you first need to understand the technology behind it. Numbers like 58083 and 24255 are called SMS short codes. They are five or six-digit numbers used by businesses to send high volumes of text messages for things like marketing, appointment reminders, and security alerts.

A key point of confusion is that these short codes are often shared. A single short code 58083 might be used by multiple, completely unrelated companies through a third-party service. For example, the same number could be used by Affirm, a job search website, and a video game streaming service.

This shared system creates a perfect opportunity for scammers. You might receive a legitimate code from one company using the 58083 short code one day, and a fake message impersonating Affirm from that same number the next. This can trick you into believing the fraudulent message is also real. Because of this, you should always focus on the content of the message, not just the number it came from.

Four Reasons You Received an Unsolicited Affirm Text

An unrequested 58083 text message or a 24255 Affirm text message can be traced back to one of four scenarios, ranging from harmless to a direct security threat.

Scenario 1: Simple Human Error

This is the most common and least dangerous reason. Another person was likely trying to log in or create an Affirm account and simply typed their phone number incorrectly, accidentally entering yours. The text code 58083 came to you by mistake. In this case, there is no risk to you.

Scenario 2: An Attempted Account Takeover

This scenario is more serious. It means a criminal may have gotten your Affirm username (your phone number) and password, likely from a data breach on another website where you reused the same credentials. When they tried to log in, Affirm’s security system worked correctly and sent the real verification PIN to you. The text is legitimate, but it serves as a critical warning that your account information has been compromised.

Scenario 3: A Targeted Smishing Attack

In this case, the 58083 short code text message is completely fake. Scammers are impersonating Affirm to trick you. The message is designed to look real and will usually contain a malicious link or ask you to reply with personal information. Their goal is to steal your login details, financial data, or install malware on your phone.

Scenario 4: Phone Number Harvesting

Sometimes, scammers use automated bots to send verification requests to thousands of phone numbers at once. They aren’t trying to get into an account immediately. Instead, they are trying to see which numbers are active and connected to an Affirm account. If Affirm’s system sends a 58083 text code, the scammer now knows your number is a valid target for future, more sophisticated attacks.

How to Spot a Sophisticated Affirm Scam: A Complete Checklist

You can learn to spot a fraudulent message by developing a critical eye. Here is a toolkit to help you analyze any suspicious text.

Analyze the Sender

While a text may come from a known short code, scammers can use other numbers. A text from a long 11-digit number or an email address is an immediate red flag.

Scrutinize the Language

Official communications from Affirm will be professional and well-written. Look for these warning signs:

- Forced Urgency: Phrases like “URGENT ACTION REQUIRED” or “ACCOUNT SUSPENDED” are designed to create panic and rush you into making a mistake.

- Spelling and Grammar Errors: Many scam messages are filled with obvious typos and poor grammar.

- Generic Greetings: A message starting with “Dear Customer” instead of your name may be part of a widespread scam.

Dissect Any Links

This is the most important step.

- Preview Before Clicking: On most phones, you can press and hold a link to see the full URL before opening it.

- Check for Fake Domains: Scammers create look-alike websites. Instead of the real affirm.com, a fake link might go to affirm-security.com or affirm.scam-site.net.

- Look for HTTPS: A legitimate financial website will always use a secure, encrypted connection, which starts with https://.

Evaluate the Request

The final test is what the message is asking you to do. Remember, Affirm will never ask you to provide a PIN, password, or your full Social Security number in a text. Any request to “verify” your account by clicking a link is a scam.

Your Immediate Action Plan for a Suspicious Text

If you believe a text 58083 is suspicious, follow this protocol immediately to protect yourself.

- DO NOT ENGAGE: Do not click any links. Do not reply, even with “STOP,” as this confirms your number is active. Do not call any phone numbers in the message.

- SAVE THE EVIDENCE: Take a screenshot of the message. This can be useful for reporting the incident.

- BLOCK THE SENDER: Use your phone’s feature to block the number to prevent future messages.

- REPORT THE ATTACK:

- To Your Cell Carrier: Forward the entire spam text to the number 7726 (which spells SPAM). This is a free service offered by major carriers to block fraudulent texts.

- To the FTC: Report the fraud attempt to the Federal Trade Commission at ReportFraud.ftc.gov.

- VERIFY WITH AFFIRM DIRECTLY:

- Do not use any contact information from the suspicious message.

- Open a new browser and go directly to the official Affirm website (affirm.com) or use the official mobile app.

- Log in to check for any notifications or unauthorized activity. If you see anything suspicious, use the official contact methods on their website to get in touch.

- PERFORM A SECURITY AUDIT: If you suspect your password was stolen, change your Affirm password immediately to something long, unique, and complex. If you reused that password anywhere else, change it on those sites as well.

Proactive Steps to Secure Your Affirm Account

The best defense is a good offense. Use these proactive strategies to keep your financial accounts safe.

Enable Stronger Authentication

Passwords are not enough. Use the biometric login options (fingerprint or face ID) in the Affirm app. Also, enable a passcode or passkey for an additional layer of security.

Practice Good Password Hygiene

Use a unique and complex password for every online account, especially financial ones. A password manager is an excellent tool for generating and storing strong passwords securely.

Monitor Your Accounts

Log in to your Affirm account and linked bank accounts regularly to review your transaction history and statements for any charges you don’t recognize.

Frequently Asked Questions (FAQ)

Q: What if I get an Affirm text but I don’t have an account? A: This is most likely the result of someone else mistyping their phone number or a random smishing attack. Since you don’t have an account, there’s no direct risk. Do not engage with the message, block the sender, and report it by forwarding it to 7726.

Q: How can I permanently stop text messages from Affirm? A: For marketing or payment reminders, you can reply STOP to any message from Affirm. However, you cannot opt out of essential security notifications like the PINs required to sign in. You can manage other notification preferences in your account settings.

Q: What other short codes does Affirm use? A: In addition to 58083 and 24255, users report receiving legitimate alerts from other numbers. For instance, a 54183 text message has been associated with Affirm Card fraud alerts. Always judge the message by its content and context, not just the number.

Q: I already replied to the text or clicked the link. What should I do now? A: If you entered your login details on a suspicious site, go to the official Affirm website immediately and change your password. If you provided other financial information, contact your bank to report the compromise. Follow the steps in this guide to report the incident to Affirm so they can investigate your account for fraudulent activity.

Conclusion

Staying safe in the digital world doesn’t require being a security expert. It’s about following a simple, repeatable process: Question any unsolicited communication, Verify the information through official channels, and Report all suspicious activity. By understanding the tactics scammers use and implementing strong security practices, you can protect your financial life from threats.